SCALING INCLUSIVE

HEALTHCARE & INSURANCE

BIMA operates at the intersection of technology, healthcare, and insurance with a model built for scale and impact. Our diversified business model unlocks multiple revenue streams while ensuring affordability and access.

Direct-to-Consumer (DTC)

Our Integration with leading mobile money platforms, telcos, and billing systems allows for seamless, recurring premium collection through mobile wallets, airtime deductions, add-to-bill services, and bank transfers—making it easier for customers to stay covered without interruption.

Embedded Insurance

BIMA partners with leading telcos, ride-hailing platforms, and digital payment providers to embed health and life insurance into services people already use. Whether bundled with mobile data, airtime, or driver accounts, embedded insurance enables low-friction, high-volume distribution—allowing customers to access coverage with no additional effort.

B2B Sales

We also provide customized healthcare and insurance packages to employers, banks, and institutions. Leveraging our B-Care ecosystem, we help corporates reduce their employees’ out-of-pocket healthcare expenses while improving health outcomes.

BIMA also works with insurers directly—helping reduce OPD and IPD loss ratios by leveraging telemedicine services and the B-Care ecosystem.

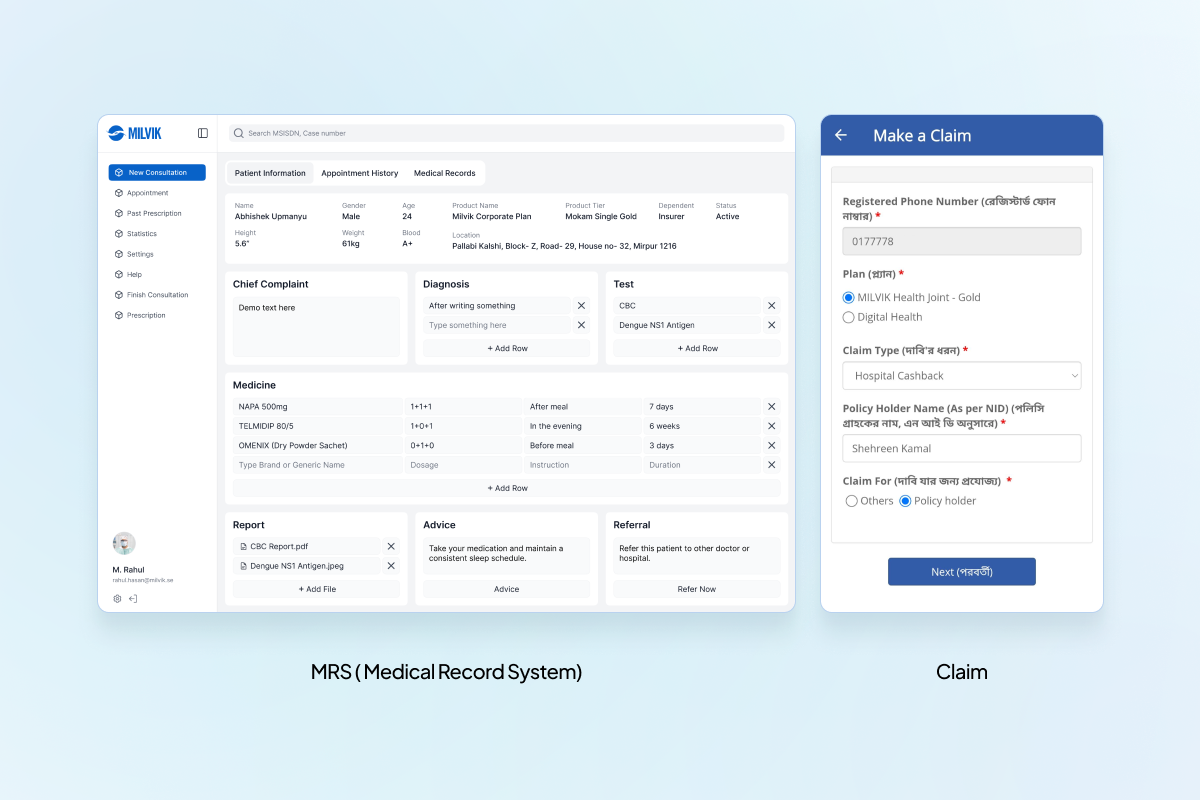

Claim System

BIMA licenses its in-house technology solutions—including AI-enabled customer service tools, claims management systems, and digital onboarding platforms—to insurers and healthcare providers.

This is a growing revenue stream for BIMA—creating value for partners while maximizing ROI on our own tech investments.

Underwriting & Risk Partnerships

Adapting to regulatory environments while retaining control over pricing and performance

BIMA’s flexibility in regulatory and licensing structures allows us to operate as a licensed underwriter, broker, or corporate agent depending on the local market. In many countries, we partner with local insurers to bring our products to market and we also work with international reinsurance partners to build scalable risk-sharing models. This hybrid approach ensures we can adapt quickly to regulatory environments while maintaining control over product design, pricing, and portfolio performance.